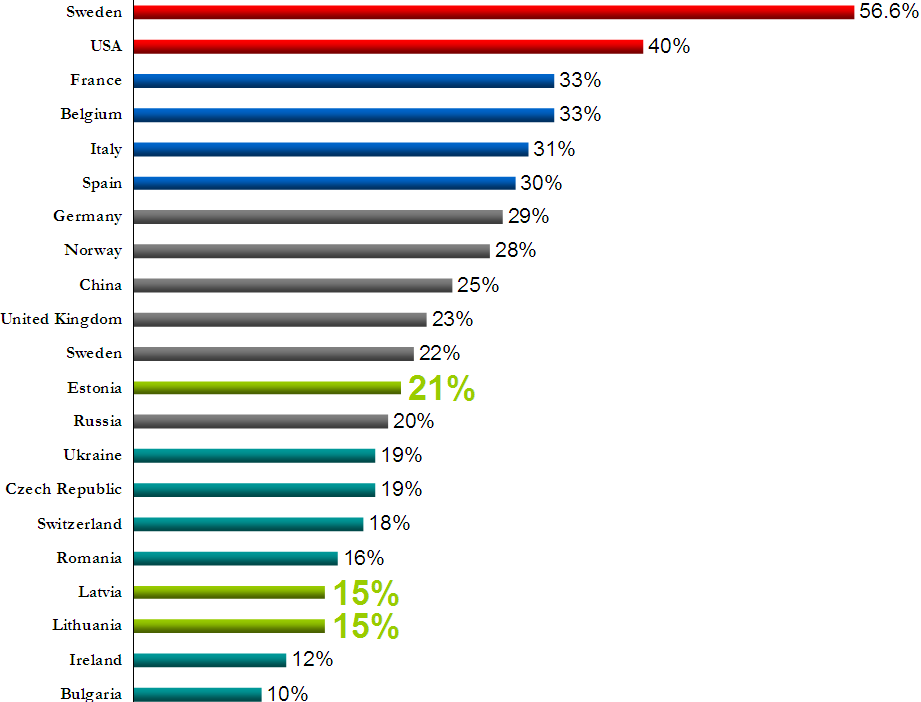

Corporate income tax in Latvia, Lithuania and Estonia comparing to other countries

CORPORATE INCOME TAX IN LATVIA

Taxpayers

Corporate income tax is paid by:

- domestic companies – residents;

- non-residents;

- permanent representative offices of non-residents that perform economic activity.

Taxable objects

Corporate income tax is applied to the profit or loss, which is calculated according to the taxpayer’s financial accounting data and adjusted according to the Corporate Income Tax Law.

In general, all types of income are included in the taxable income consisting of:

- income earned in Latvia or abroad (for residents);

- certain types of income earned in Latvia and listed in the Corporate Income Tax Law (for non-residents);

- income earned in Latvia from performing commercial activities (for permanent representative offices of non-residents).

Tax rate in Latvia

The flat corporate income tax rate is 15% of the taxable income.

For reduced tax rates please contact our lawyers and tax advisors.

Taxation of dividends

Payments of dividends between domestics companies are not subject to corporate income tax. Dividends paid to a legal entity – a resident of a European Union member state or a resident of the European Economic Area – are exempt from taxation.

Dividends paid to a legal entity outside the European Union or the European Economic Area, are subject to a 10% tax payable at the time of their payment.

Taxation of income of non-residents

Corporate income tax in Latvia is applied to the following payments to legal entities – non-residents, if they do not have a permanent representative office in Latvia, in accordance with tax rates stipulated in the Corporate Income Tax Law:

- management and consulting services – 10%;

- income from investments in a partnership – 15%;

- interest, if the persons paying and receiving the interest are interconnected – 5 or 10%;

- income from intellectual property – 10% or 15%;

- compensation for the use of property located in Latvia– 5%;

- compensation for expropriation of property located in Latvia– 2%;

- payments to persons located in low-tax or tax-free countries or territories – 15%.

Filing tax declarations

Declarations for a particular taxation year shall be filled by taxpayers through the Electronical Declaration System and submitted to the State Revenue Service. Tax declarations shall be submitted simultaneously with the company’s annual report.

Tax payment deadline

Taxpayers shall pay the tax calculated in their tax declarations to the state budget within 15 days of submitting the tax declaration.

Each month during the taxation year, taxpayers shall pay monthly corporate income tax advances.

Tax incentives and relief

When calculating the amount of corporate income tax, taxpayers shall receive the following incentives and tax relief:

1) Incentives to facilitate investments:

2) Incentives for research and development:

3) Industry incentives:

4) Discounts for charitable purposes:

5) The possibility of carrying forward losses:

6) Relief for having savings for doubtful debts:

Taxation treaties with more than 50 countries

CORPORATE INCOME TAX IN ESTONIA

Taxpayers

Corporate income tax is paid by:

- domestic companies – residents;

- permanent establishments of non-residents that perform economic activity (including branches);

- non-residents acting as employers in Estonia

Taxable objects

Corporate income tax is applied to the following:

- corporate profits distributed in the tax period;

- gifts, donations and representation expenses;

- expenses and payments not related to business

- fringe benefits (taxable at the level of employer)

The transfer of assets of the permanent establishment to its head office or to other companies is also treated like a distribution.

Tax rate in Estonia

Corporate income tax rate is 21/79 to net payments and 21% to gross payments. Tax is calculated of the net payment.

Taxation of dividends

Tax from profit distribution is withheld by the legal person. For the recipient, dividends are not taxable income and additional income tax is not withheld on the amount of dividends.

Redistribution of dividends is not taxed:

- Dividends received from subsidiary domiciled in the EEA Member State or Switzerland (except low tax jurisdictions) – are not taxed with income tax if at least 10% of the shares or votes in the subsidiary is held by Estonian company.

- Dividends received from subsidiary domiciled in another country (outside of EEA Member States and Switzerland, except low tax jurisdictions) – are not taxed with income tax if at least 10% of the shares or votes in the subsidiary is held by Estonian company and if income tax has been withheld or paid.

Under certain conditions the exemption method is applied to the dividend paid out of profit attributed to a resident company’s permanent establishment. Under certain conditions the income tax is not charged on dividends or on payments upon a reduction in share capital or contributions, redemption of shares or liquidation of a legal person. The threshold for the application of participation exemptions is 10%.

When a resident company or a non-resident legal person acting through its permanent establishment in Estonia has received payments from abroad, the income tax paid abroad may be deducted from the taxable amount of profit distributed in Estonia. Income tax paid in a foreign state on the income which was the basis of the payment not taxable in Estonia shall not be taken into account for deduction.

Taxation of payments to non-residents

In Estonia income tax is withhold on following payments made to non-residents:

- rental payments – 21%;

- fees for services provided in Estonia – 10%;

- royalties – 10% and 0% (royalty payments are exempt from from tax if the recipient is an associated company of the paying company and is resident in another EU Member State or Switzerland or this company’s permanent resident is in another EU Member State or Switzerland)

- interests – 0% and 21% (21% applies when interest exceeds the market interest rate)

Under tax treaties these tax rates may be reduced.

Filing tax declarations

As the tax period of corporate entities is a month, the income tax shall be returned and paid monthly by the 10th day of the following month.

Tax payment deadline

Taxpayers shall pay the tax calculated in their tax declarations to the bank account of the Tax and Customs Board not later than by the tenth day of the calendar month following the period of taxation

Tax incentives and relief

There are no special tax incentives in Estonia. Tax incentives or exemptions arising from tax treaties can be applied only if the recipient of the payment has certified his/her residence status to the withholding agent.

Taxation treaties with more than 50 countries

CORPORATE INCOME TAX IN LITHUANIA

Taxpayers

Corporate income tax is paid by:

- domestic companies – residents;

- non-residents;

- permanent representative offices of non-residents that perform economic activity.

Taxable objects

Corporate income tax is applied to the profit or loss, which is calculated according to the taxpayer’s financial accounting data and adjusted according to the Corporate Income Tax Law.

In general, all types of income are included in the taxable income consisting of:

- income earned in Lithuania or abroad (for residents);

- certain types of income earned in Lithuania and listed in the Corporate Income Tax Law (for non-residents);

- income earned in Lithuania from performing commercial activities (for permanent representative offices of non-residents).

Tax rate in Lithuania

The flat corporate income tax rate is 15% of the taxable income.

For reduced tax rates please contact our lawyers and tax advisors.

Taxation of dividends

Payments of dividends between domestics companies are not subject to corporate income tax. Dividends paid to a legal entity – a resident of a European Union member state or a resident of the European Economic Area – are exempt from taxation.

Dividends paid to a legal entity outside the European Union or the European Economic Area, are subject to a 15% tax payable at the time of their payment.

Taxation of income

Corporate income tax in Lithuania is applied to the following payments in accordance with tax rates stipulated in the Corporate Income Tax Law:

- interest – 0% (if paid to EEA or to a country with which Lithuania has a tax treaty) or 10%;

- royalties – 0% (if paid to EU resident company) or 10%;

- capital gains from sale and lease of real estate located in Lithuania– 15%;

- income from performing and sports activities– 15%;

- payments to persons located in low-tax or tax-free countries or territories – 15%.

Filing tax declarations

Declarations for a particular taxation year shall be filled by taxpayers through the Electronical Declaration System or on paper forms and submitted to the State Taxes Inspection. Annual tax declarations shall be submitted by 1st June of the following year.

Tax payment deadline

Taxpayers shall pay the tax calculated in their tax declarations to the state budget by the 1st October.

In some cases taxpayers must pay advanced corporate income tax on a quarterly basis: by the last day of each quarter of the tax period. Advance payments are not mandatory if profit of a taxpayer does not exceed 290.000 EUR for the previous year.

Tax incentives and relief

When calculating the amount of corporate income tax, taxpayers shall receive the following incentives and tax relief:

1) Incentives to holding companies;

2) Incentives for research and development;

3) Tax relief for investment projects;

4) Tax relief for Free Economic Zone (FEZ) companies;

5) The possibility of carrying forward losses.

Taxation treaties with 48 countries